By Naomi Rovnick and Karin Strohecker

LONDON (Reuters) - Global bond and equity markets are ending the first quarter on a high note, with investors poised for more wild swings ahead after months of the mood lurching between optimism and pessimism about prospective rate cuts from major central banks.

MSCI's global share index, which smashed through record highs in March, is up 10% since mid January after traders dropped earlier bets for as many as seven U.S. rate cuts in 2024 but then chose to celebrate the idea of cuts starting in June.

Switzerland last week kicked off an easing cycle among big, developed economies. And while traders almost fully expect the Federal Reserve to lower U.S. borrowing costs from 23-year highs in June and the European Central Bank to cut its deposit rate from 4% then too, caution could follow.

Dennis Jose, head of equity strategy at Exane BNP Paribas, said central banks could lower borrowing costs in the summer but might then pause if economic growth improves -- raising the odds of further labour market tightness, wage growth and inflation.

"I think it may be better to travel than arrive at that first rate cut," he said.

EVERYTHING RALLY

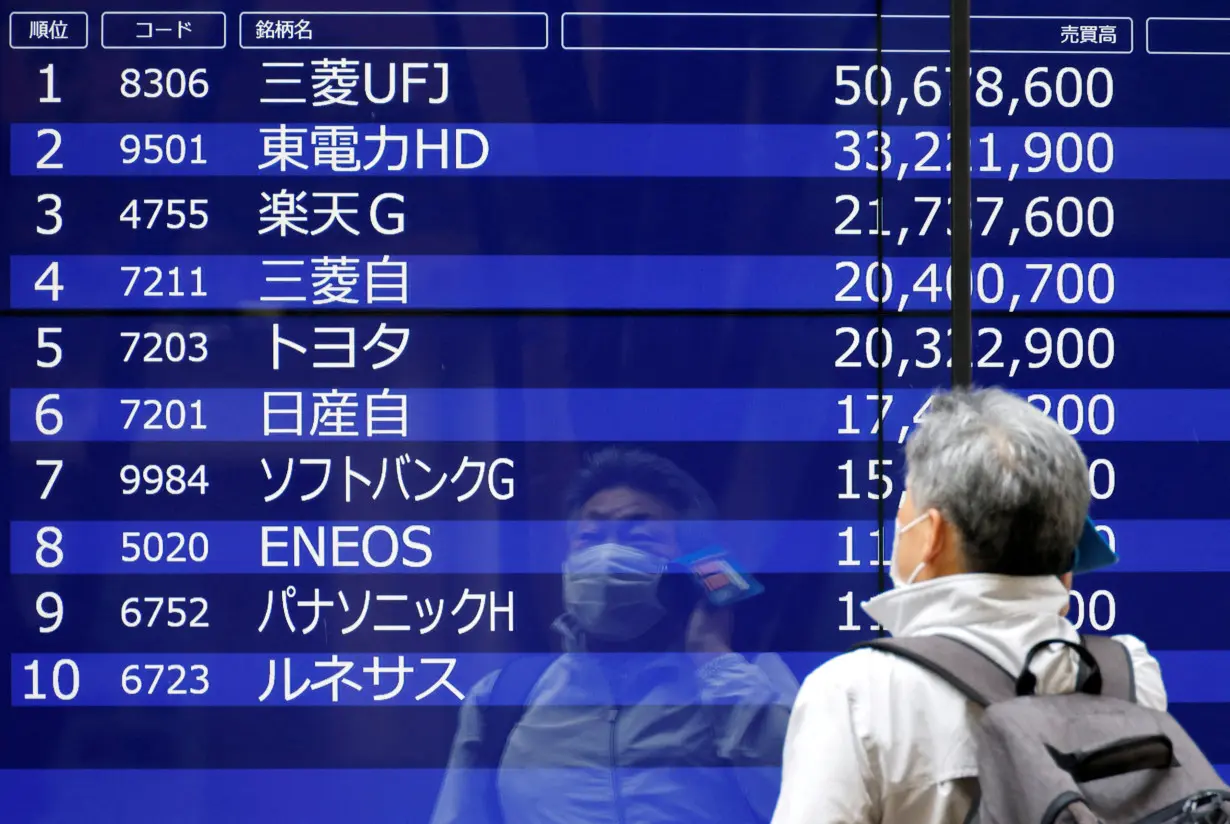

A global government bond index posted its first monthly gain of 2024 in March as the quarter's rally became a buy-everything frenzy, sending Japanese stocks past their 1989 bubble-era high and powering stunning gains for emerging market debt.

Wall Street's S&P 500 index and Europe's STOXX 600 index are near record levels.

Of major markets, only China was left out of the party as its once-roaring industrial growth engine continued to sputter.

But it was really those high-yielding emerging market international bonds that enjoyed some stellar rises - as idiosyncratic reasons for optimism were magnified by U.S. rate cut hopes.

Argentina's international bonds returned more than 25% in the first quarter, fired up by hopes over the radical reform agenda of chainsaw-wielding new President Javier Milei. Pakistan matched those gains when a new government emerged from delayed, inconclusive elections, now setting out to secure a fresh multi-billion IMF deal. Returns for embattled Ukraine also surpassed 25% while Egyptian debt benefited from capturing billions of dollars from Abu Dhabi and a new IMF deal.

"High-yield EM sovereigns have strongly outperformed since 4Q23, buoyed risk-seeking from Fed pivot, easing of external financing conditions, and IMF and GCC financing support has been on the rise as China’s financing have stabilized," said Citi strategist Johann Chua.

In commodity markets, a supply shortage has pushed cocoa futures to record highs, and in currencies the paring back of Fed rate cut bets has left the dollar sailing high again.

The dollar index, which measures the greenback's value against other major currencies, ends the quarter up almost 3%. Its strength has created more pain for both major and developing economies, with markets alert to Japanese intervention to bolster a yen trading near 34-year lows.

MIXED SIGNALS

With investors now banking on a so-called "no landing" scenario of rate cuts without recessions, some analysts warned about the fallout from conflicting economic signals.

"This is a weird (economic) cycle where nothing is quite what it seems and you've got all these conflicting signals right now," said Andrew Pease, global head of investment strategy at Russell Investments.

"This is not the sort of environment where you want to sit back and buy in to the prevailing optimism."

So, even as markets bet on rate cuts, purchasing managers' surveys show U.S. and euro zone business activity picking up.

Brent crude oil is up 13% over the quarter, after the International Monetary Fund raised its global growth forecast in January and the International Energy Agency hiked its oil demand outlook in March.

Zurich Insurance Group's chief market strategist Guy Miller said that while markets embraced the idea of better economic growth supporting companies' earnings, recession risks should not be forgotten.

"There is still a risk of recession in the U.S. and that shouldn't be underestimated. And therefore as an investor, you have be clear on what is driving markets and what, if any, risks are being priced in."

A Deutsche Bank survey of 250 investors this month found that almost half expected no U.S. recession and inflation to still be above the Fed's average 2% goal by end-2024.

More than half of those investors surveyed believed the S&P 500, which influences the direction of stocks worldwide, was more likely to fall by 10% than to rise by that amount.

"It would be a very different situation (to now) if inflation surprises to the upside and rate cuts have once again to be pushed further and further out. Financial markets would suffer," Zurich's Miller said.

(Reporting by Naomi Rovnick, Karin Strohecker; Additional reporting by Dhara Ranasinghe; Editing by Dhara Ranasinghe, William Maclean)